Automate real analyst workflows, not just chat.

FinAI turns filings, market-data feeds and internal models into finished comps, KPI packs and IC memos in minutes.

Trusted by

Why analysts are drowning in manual work.

KPI extraction from filings

Hours spent manually parsing 10-Ks, 10-Qs, and earnings transcripts to build comparable company tables.

Trading comps and precedents

Repetitive data gathering from CapIQ and PitchBook, reconciling multiples, and formatting to house style.

IC memo drafting

Synthesizing research, market data, and internal models into investment committee-ready narratives.

Formatting to house templates

Manual copy-paste into PowerPoint decks and Excel models that follow firm-specific conventions.

A workflow engine built for finance, not a chatbot.

Three pillars power every FinAI automation

Knowledge

Connects to filings (SEC, Companies House), S&P CapIQ / PitchBook, news feeds, and internal data rooms. Real-time access to the sources analysts already use.

Memory

Learns each firm's templates, naming conventions, and source hierarchy. Adapts to your house style, not the other way around.

Execution

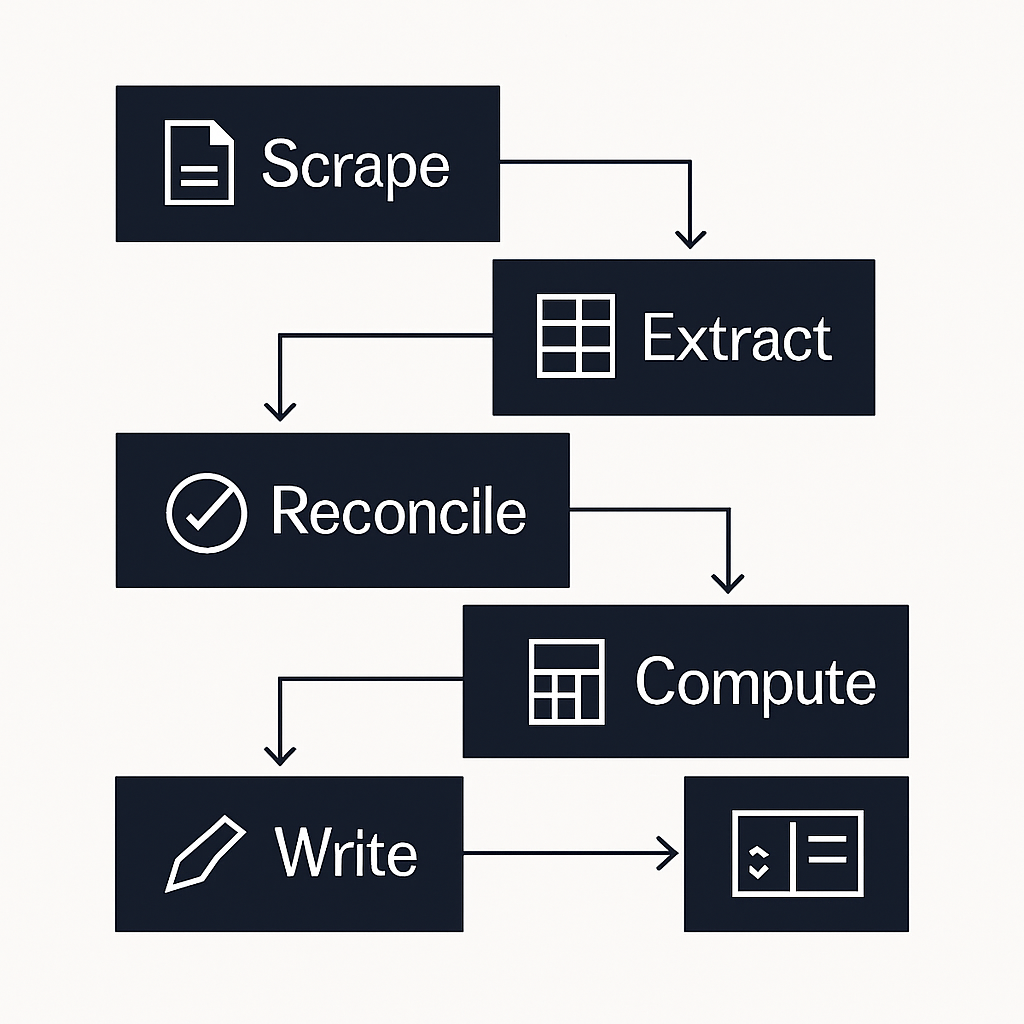

Multi-step automation: scrape → extract → reconcile → compute → write → deck. End-to-end workflows, not just Q&A.

Key workflows automated

Click any workflow to see the step-by-step process

Built for front-office finance teams

Boutique IB

Small teams executing complex M&A and capital raises without the analyst bench of bulge brackets.

PE / VC funds

Investment professionals screening deals, building models, and preparing IC materials under tight timelines.

Corporate development

In-house M&A and strategy teams managing deal flow, comps, and board presentations.

Independent consultants

Deal advisors and fractional CFOs delivering institutional-grade analysis to clients.

Why FinAI vs generic AI tools

ChatGPT and Claude are great for brainstorming. FinAI is built for production-grade deliverables.

Structured outputs

Generates tables, models, slides, and memos—not just free-text responses. Ready to present or hand to clients.

Licensed data + filings

Uses your CapIQ/PitchBook subscriptions, SEC filings, and internal models. Full audit trail for every data point.

Analyst-grade accuracy

Cites sources, shows retrieval path, and flags conflicts. Built for diligence, not just speed.

Security & data

Enterprise-grade security for sensitive financial workflows

Bank-grade security

SOC 2 Type II, encryption at rest and in transit, regular penetration testing.

SSO & role-based access

Integrate with your identity provider. Control who sees what data and workflows.

No model training on your data

Your filings, models, and internal data never train our AI. Full data isolation.

Works on top of your existing CapIQ/PitchBook licenses. We don't replace your data providers—we make them more productive.

Simple, transparent pricing.

Start with a pilot on your existing CapIQ or PitchBook license. Scale as your team grows.

Starter

Students, independent consultants, early-career bankers

What you get:

- KPI extraction

- Basic comps automation

- Memo drafting

- Monthly usage limits

Huge volume, low-touch onboarding. Funnels users into Pro tier as workflow needs grow.

Pro

Small teams (3–20 users) at boutiques, advisors, analyst teams

What you get:

- Full workflow automation

- Team workspace + workflow memory

- Priority model updates

- Higher usage thresholds

Mid-market engine of ARR. Higher retention due to embedded workflows. Early adopter firms need workflow memory + formatted output.

Enterprise

Banks, asset managers, consulting firms, corp-fin teams

What you get:

- Full automation suite + dashboards

- SOC2-grade security & audit logs

- SSO, RBAC, custom integrations

- Dedicated account manager

Highest compliance & security. Enables ARR scaling into £1m+ range. Multi-year commercial partnerships.

All plans work on top of your existing CapIQ, PitchBook, FactSet, or Refinitiv license. FinAI is a workflow layer, not a data reseller. No new vendor to manage.

Built for enterprise finance.

Bank-grade security, vendor partnerships, and compliance—so you can trust FinAI with your most sensitive workflows.

Enterprise-grade security

SOC2 Type II certified, encryption at rest and in transit, regular penetration testing, and full audit logs for compliance.

SSO & role-based access

Integrate with your identity provider (Okta, Azure AD, etc.). Control exactly who sees what data and workflows.

No model training on your data

Your filings, models, and internal data never train our AI. Full data isolation and inference-only usage.

Vendor-approved integrations

Deep partnerships with CapIQ, Refinitiv, PitchBook, and FactSet. FinAI increases usage of your licensed data, not replaces it.

Full audit trail & citations

Every number is traceable: source, document, page, extraction step. Built for diligence and regulatory review.

Compliance-ready

ISO 42001 roadmap, GDPR/CCPA compliant, EU data residency options, and full documentation for vendor reviews.